Snap Dragon – Stats

Snap Dragon

A Professional Quant Based Portfolio Trading Strategy

Snap Dragon is a quant based, hedge fund level trading strategy using S&P 500 stocks. It is the brain child of Cesar Alvarez whose quant-based stock trading strategy creation is considered amongst the best in the financial industry. Snap Dragon is the only quant-based strategy that we currently know of that uses a combination of mean reversion, volatility metrics, dynamic exits and momentum to produce returns that average 14% per year with hold time of 70 trading days. It is unique in that since 2007, this strategy has produced significant S&P 500 outperformance, with long hold times (around 3 months). .

- Many yearly returns over 20%

- Can be traded with just fifteen minutes on the weekend

- Multiple portfolio based strategies to choose from

- Trades only S&P 500 stocks

- Long trades only

- Results live from May 2018

Start your free

7-day trial now

I have been trading and doing research with Cesar for almost 20 years. We look for market trading strategies and market inefficiencies on almost a daily basis. But, it’s not often-that we find something totally new. Totally different. Something that really impresses both of us. When we started working on this idea and saw the results it produced and how robust the results were-we both looked at each other and said-"let’s start trading it. This is the one of the best trading strategies we’ve ever found."

LONG HOLDING PERIODS

Snap Dragon has a hold time of roughly 70 days and still manages to stay only about 68% correlated with the S&P 500 while handily beating the indices every year.

One of the biggest challenges I've found in my 25 years of building trading strategies has been to have longer hold times and still outperform the indexes. The reason why is that as you hold positions longer, you generally tend to follow the index itself and it becomes harder to find strong edges. We did that here.

PICKS UP MOMENTUM RUNS TO THE UPSIDE, WITHOUT THE DOWNSIDE OF BUY AND HOLD

Whether we are trading short term mean reversion (where there are lots of edges), ETF bear strategies, or short volatility—the ultimate goal is to combine a mid-term holding strategy that complements your other strategies.

One thing that tends to happen with short term strategies is that those strategies tend to miss out on market runs to the upside. This strategy captures runs to the upside.

On strong market runs, the strategy stays in the trade and picks up the big returns.

When the market is down, Snap Dragon does not go down as much as the market (alpha).

It is the perfect strategy to add to your portfolio. If you have buy and hold or trade any other short-term strategy, Snap Dragon has a time frame that is very unique. It behaves very differently than just about every other quant strategy that we've seen.

Cesar's trading buddy and fellow researcher

Choose the Portfolio that is Best for You

Testing period is from January 1, 2007 to September 30, 2023 and metrics are updated after the end of each quarter.

Live trading signals have been published on the site since May 2018.

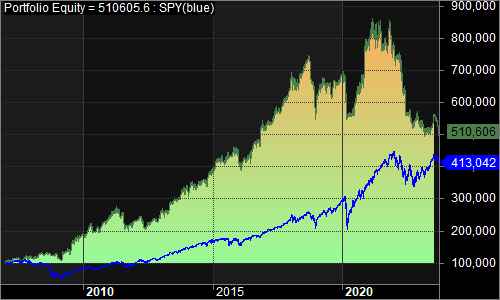

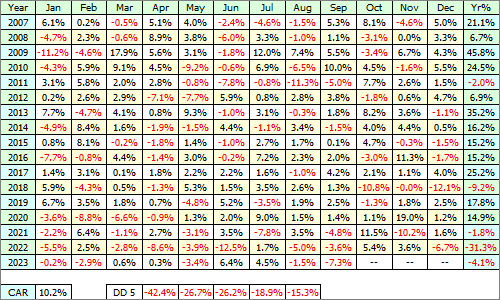

Portfolio 1 - Costa(EOD)

This portfolio can have trades anytime during the week. Stops and profit targets are evaluated after the close and executed on the next day.

Portfolio Statistics

- 10.2% Compounded Annual Returns

- 82.8% Exposure

- 0.52 Sharpe Ratio

- Top three drawdowns(-42.4, -26.7, -26.2)

- -23.1% Worst 3 month return

- -35.2% Worst 12 month return

- +28.28% Best 3 month return

- +74.74% Best 12 month return

- 0.73 correlation with the S&P500 index

Trades Statistics

- 415 Trades with 56.87% winners

- 16.5% Average % profit on winning trades

- -13.4% Average % loss on losing trades

- -51.9% Worst trade

- 79.9% Best trade

- Maximum of 8 positions

- 12.5% percent of portfolio per position

- 43% Stop Loss exits

- 57% Profit Target exits

- 69 average trading days held

Here is a recent trade

Equity curve since 2007

Monthly returns

I have over a decade of quant trading experience and am the Chief Investment Officer for a quant-based advisory firm. I’ve known Cesar for 8 years and he is my first and foremost “go-to” resource for financial markets research, quantified strategy development, and coding. Unlike some theoretical “quants,” Cesar is also a trader. He understands the markets and the real-world limitations of broker order offerings, liquidity, and order placement.

Rob Davenport, LCA Capital, LLC?

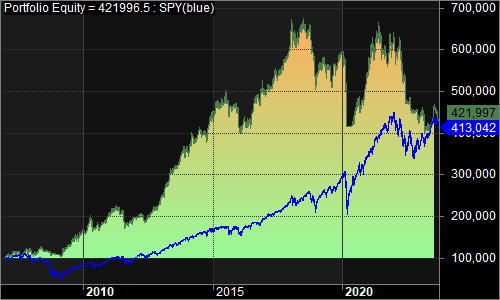

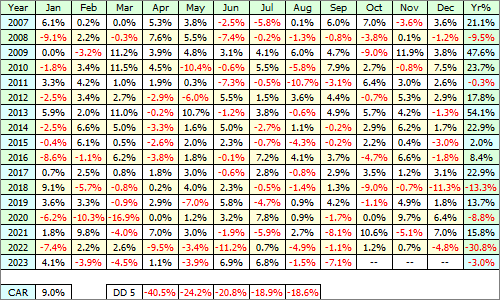

Portfolio 2 - Potomac(EOW)

Only need to check for trades on the weekends. Trades are entered and exited on first trading day of the week. This portfolio requires the least amount of work to follow.

Portfolio Statistics

- 9.0% Compounded Annual Returns

- 83.7% Exposure

- 0.45 Sharpe Ratio

- Top three drawdowns(-40.5, -24.2, -20.8)

- -30.1% Worst 3 month return

- -32.0% Worst 12 month return

- +22.23% Best 3 month return

- +65.65% Best 12 month return

- 0.72 correlation with the S&P500 index

Trades Statistics

- 386 Trades with 57.25% winners

- 17.1% Average % profit on winning trades

- -14.2% Average % loss on losing trades

- -51.9% Worst trade

- 59.3% Best trade

- Maximum of 8 positions

- 12.5% percent of portfolio per position

- 40% Stop Loss exits

- 53% Profit Target exits

- 64 average trading days held

Here is a recent trade

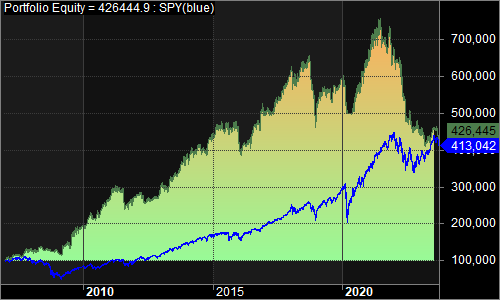

Equity curve since 2007

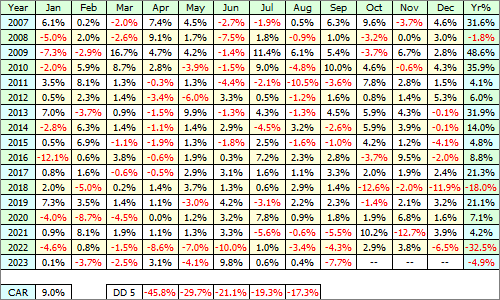

Monthly returns

There’s no way I’d be professionally managing money today were it not for the professional advice and help of Cesar Alvarez. I’ve yet to meet a trader/researcher with such a superb understanding of the markets; as well as the dangerous trapdoors that await if you decide to develop your own quant system.

Mark Angil, Architect of Midway II, 1st Place Winner of BattleFin’s Sharpe Ratio Shootout International Quant Finance Tournament 4.0 (Pro Division)

Portfolio 3 - Sonnet(Intraday)

Only need to check for trades on the weekends. Profit and stop exit orders need to be place as Good-Til-Cancelled for the week. Each weeke these prices are updated.

Portfolio Statistics

- 9.1% Compounded Annual Returns

- 79.3% Exposure

- 0.49 Sharpe Ratio

- Top three drawdowns(-45.8, -29.6, -21.1)

- -24.5% Worst 3 month return

- -36.9% Worst 12 month return

- +27.27% Best 3 month return

- +71.71% Best 12 month return

- 0.70 correlation with the S&P500 index

Trades Statistics

- 423 Trades with 55.56% winners

- 16.1% Average % profit on winning trades

- -12.7% Average % loss on losing trades

- -30.2% Worst trade

- 74.5% Best trade

- Maximum of 8 positions

- 12.5% percent of portfolio per position

- 44% Stop Loss exits

- 55% Profit Target exits

- 74 average trading days held

Here is a recent trade

Equity curve since 2007

Monthly returns

I have been corresponding with Cesar and following his work for several years. His research is first rate and his reports are clear and unambiguous. He is an expert trading system developer and programmer. Most importantly, he has discovered profitable and persistent patterns, and developed profitable and practical trading systems around them.

Recognized Quant Author

Snap Dragon portfolios have over 2 times the return with less than one-half the drawdown.

Start your free one week trial

During your trial you will have access to all previous trades and commentary. Cesar or Steve are available to answer your questions.

Start your free

7-day trial now

The Researchers

Cesar Alvarez

Cesar is well known in the quant community from his trading blog, Alvarez Quant Trading, where he shares his trading insights and research. He also consults with traders to test their trading ideas and help them improve their current strategies. From 2004 to 2013, Cesar was the Director of Trading Strategies at TradingMarkets.com and Connors Research. Cesar has also developed many strategies for private equity funds, is the author of multiple books on trading, and — in a former life — was a Software Engineer on the early versions of Microsoft Excel. After so many years developing well over 100 different methodologies, Cesar, like many true masters of his profession, has come back to the point of ultimate simplicity and efficiency as the best sustainable approach to active trading.

and Steven Gabriel

Steven has an extensive history trading equities, options, futures, and volatility. For the past 13 years he has been a quant-based trader, working alongside Cesar on research for 100’s of different ideas, concepts, strategies, and systems. Steve is also an Emergency Room physician. But he only practices medicine half-time now, because his success in trading financial markets.

Frequently Asked Questions

Are these simulated results? Yes, these are simulated results. Read the disclaimer for more details.

Click here for more FAQs

Still can't find your question answered, contact us.