You need to purchase Tranquility Trading Crew Platinum Membership to get access to these strategies.

Research Queue & Current Research Project

See what is on the list for possible research projects on the Research Queue page

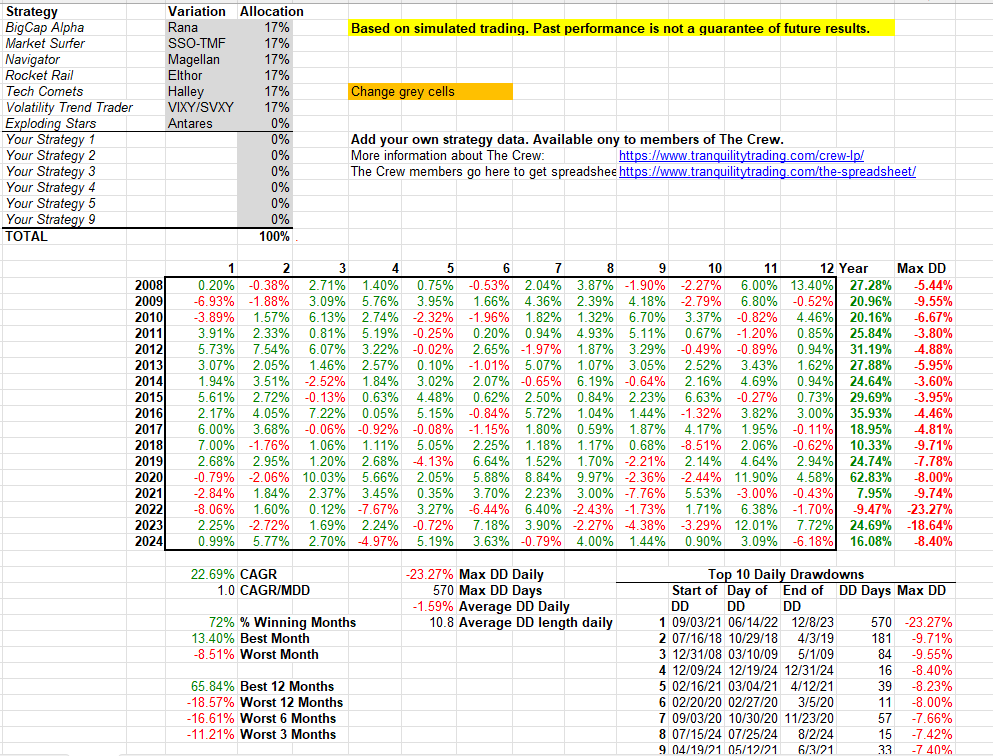

The Tranquility Trading Spreadsheet

Combine the Tranquility Trading strategies to create your ultimate high return portfolio using The Spreadsheet.

Crew Strategies

These strategies have full rules explained along with spreadsheets.

Any strategies created by The Crew while you are a member you will have immediate access to. Other strategies you will have to wait until you have been a member long enough to get access to them.

If you have an idea of a strategy that you want tested, go the forums and post your idea.

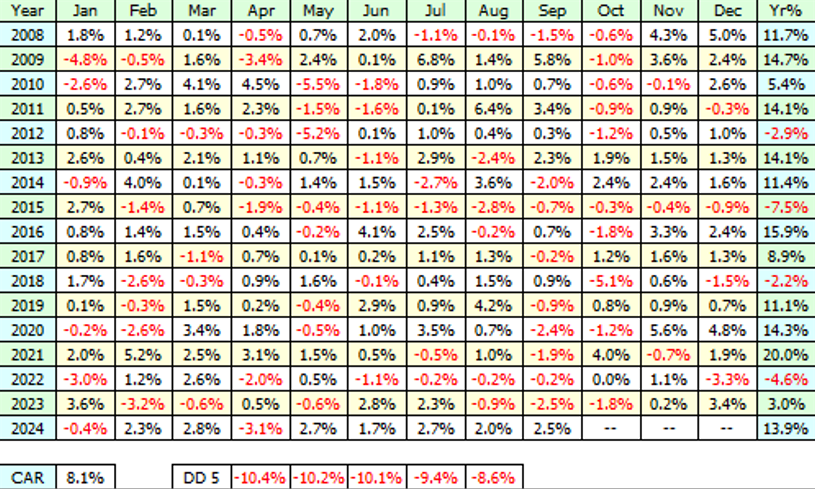

ETF Monthly Momentum

Trades a basket of ETFs each month. Entering those that have the highest momentum over the lookback period.

Nasdaq Weekly Mean Reversion

Trades Nasdaq 100 stocks on weekly timeframe looking for pullbacks.

Stock Bollinger Band Breakout

Trades stocks on weekly timeframe looking for breakouts of the top Bollinger band.

Monthly Stock Rotation using Momentum & Low Volatility

A monthly rotation strategy that combines momentum and low volatility on NASDAQ 100 and S&P 500 stocks.

ETF Snapping Bear

An ETF shorting strategy that looks for weekly low being made and then a bounce.

Snake Charmer

A long two-rule QQQ strategy that infrequently trades but has big winners with only 2 day holds.

Stock Weekly Breakout Strategy

Trades Nasdaq 100 or S&P 600 stocks on weekly bars looking for a weekly breakout.

Clenow Plunger Strategy

Trades Nasdaq 100 stocks that in long term uptrend and entering on pullback when trend followers are exiting.

Mean Kitty Strategy

Mean Kitty aims to provide market-like long-term returns at significantly lower volatility. It does so by trading the mean-reversion of S&P sector ETFs.

Angil Short Strategy

The Angil Short Strategy looks to short highly overbought S&P500 stocks when the $SPX is below the 200-day moving average. This is a good strategy to look at to potentially complement any strategy taht you are trading that stops trading when the market is below the 200-day moving average.

Failed Research

We publish all test results because we want to show that not all ideas produce a strategy that is tradeable.

Tranquility Trading Strategies

These are black box strategies that non-Crew members must subscribe to. As a Crew member you get them for free. No rules are given.

Tech Comets uses momentum, trend and market timing on NASDAQ 100 stocks. It’s all quantified. It’s robust. And we think it’s the best, most reliable, and highly profitable momentum quant strategy we’ve encountered. Period.

Big Cap Alpha enables you to achieve market beating returns trading S&P 100 stocks. The general concept underlying Big Cap Alpha is that equities tend to revert to their recent price ranges when they get stretched too far. We’ve extended this concept by incorporating multiple measures of price “stretching” into our entry/exit decisions.

Volatility Trend Trader is the result of analyzing volatility in a completely new way. We have scoured the web and can not find anyone looking at volatility in this way. The back-tested results are profound.

And more… Read about The Crew here.